Financial data Application programming interfaces or APIs are one of the emerging innovation triggers of the banking and financial services industry as per the Gartner Hype Cycle for Digital Banking Transformation, 2022. APIs help financial institutions (FI) create products that can meet customer demand in the times of fintech penetration into the mainstream. API-based open banking is a mechanism wherein traditional retail banks open their application programming interfaces for third parties to create new apps or services.

The percentage of banks and credit unions that have invested in developing APIs has grown from 35% in 2019 to 47% in 2021, says PYMNTS data.

Open banking using APIs is a way for incumbent financial institutions and banks to partner with fintech rather than holding a competition with them. In this first part of our three-part series of API-based open banking insights, we shall holistically discuss-

- What is Open Banking or API Banking?

- How do banking APIs work

- Why incumbent financial institutions must move from the status quo?

CMOs, CIOs, and C-Suite executives of financial services companies and retail banks can gain usable insights from this series of open banking to build an API-enabled digitally advanced product or service platform.

What is Open Banking or API Banking?

Open Banking or API-based Banking is defined as APIs (XML/JSON codes) for allowing bank and client servers to communicate securely with one another. API banking makes data transfer between these entities seamless and ensures secured integration between the bank and customer’s systems. This capability of APIs enables customers to carry out their banking transactions without toggling between their Enterprise Resource Planning or ERP platform, and the bank.

How do Banking APIs Work?

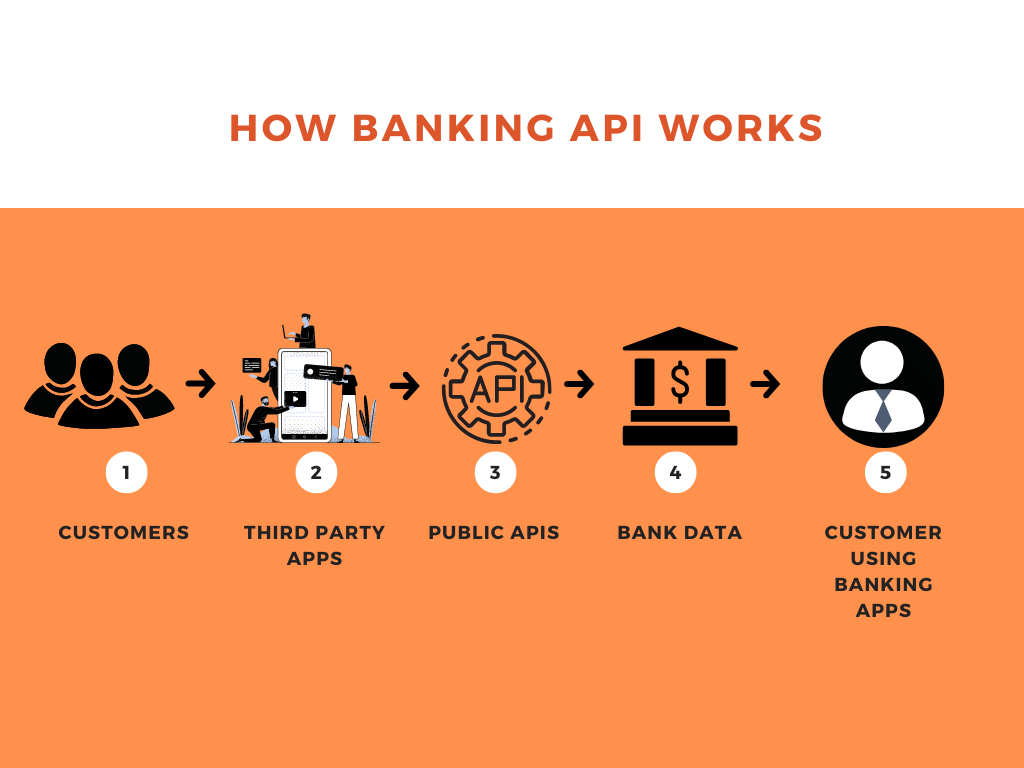

Non-banking companies are developing and facilitating a range of core financial services to clients by connecting with APIs of financial services companies, FIs, and retail banks. This has led to the emergence of platforms connecting clients with bank APIs. These platforms pitch themselves as banking-as-a-service (‘BaaS’) or middleware.

At the back end, an intermediate layer connects with banks and regulated entities. On the front end, it hosts various fintech companies and non-bank entities (Fig. 1). So, the API platforms act as the infrastructure. In contrast, non-banking enterprises and fintech companies integrate financial and banking services in their non-financial offerings.

Why Move From the Status Quo?

According to Accenture, 29% of banks’ traditional retail products-based revenue streams are at risk. Most bankers expect a 10% increase in overall organic banking growth. While, in 2020 alone, there was a 55% boost to banking revenue from new opportunities created by open API-enabled services.

The adoption of open banking or API banking has gained traction over the last decade across the globe. There has been a significant difference in its interpretation, reception, and adoption from one country to another. Yet, if we mainly speak about market readiness in India, there has been a significant surge in the FinTech space.

Pertaining to the competitive landscape, financial institutions have taken active steps to educate the customer, invested in increasing distribution, and offered rewards to drive customer behavior. Account aggregation use cases are expected to scale up.

Key Takeaway

Whether the banking industry also continues to thrive in the retail financial services segment will depend entirely on how well they navigate the next few years along with open banking. The success stories will be those that can stand the ground with flexibility and imagination to create offerings by meticulous use of APIs and bringing together multiple domains, within and outside of financial services. To explore the growth potential, C-suite executives must also be aware of the global open banking situation. In the next part of this series, we explain the challenges and opportunities of adopting an open banking business model.