77% of the marketers in the Pharma sector believe that the omnichannel commercial model is the right way forward. One dimensional strategies with limited healthcare practitioners (HCP) engagement and disconnected promotions are no longer considered best practices. Even as face-to-face HCP visits still remain relevant in Asian markets, they too have reached the tipping point in terms of effectiveness. 87% of healthcare providers (HCPs) want either virtual or a mix of virtual and in-person meetings with pharmaceutical reps, suggests Forbes. As a response, pharma companies in the Asian markets have started to transform the way HCPs interact. At the core of new digital strategy is aggregation and synthesizing of behaviors and trends via deep insights, actionable data and advanced analytics.

However, misconceptions and myths around omnichannel, analytics and digital approach remain a key problem in Asian market. Over 50% of the senior marketing executives in pharma companies struggle to gather actionable insights itself from data as per a report by Eversana. In this blog, we aim at answering these challenges around adopting analytics-based omnichannel commercialization in Asia for pharma, and develop a four step digital strategy (Fig. 1).

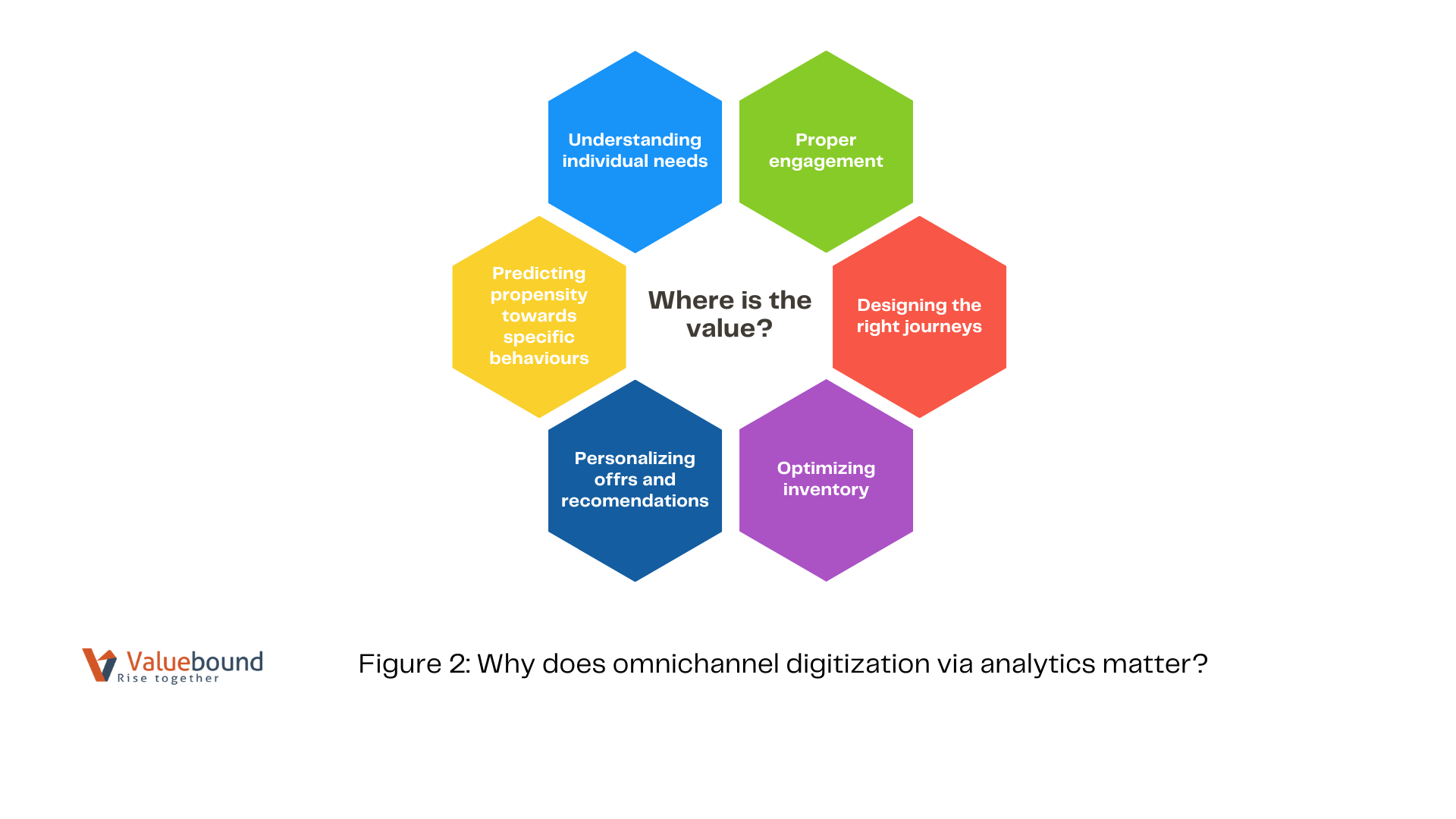

Why does omnichannel digitization via analytics matter?

While sectors like banking, retail, and media have already seen benefits from the use of Advanced Analytics (AA), pharma is yet to improve its commercial model through data which can be positioned as the strategic asset. Today, sales reps find it challenging to customize and optimize the complex channels, frequency of interactions, and content for specific HCPs who expect relevant and tailor-made content to their patients and practice (Fig. 2)

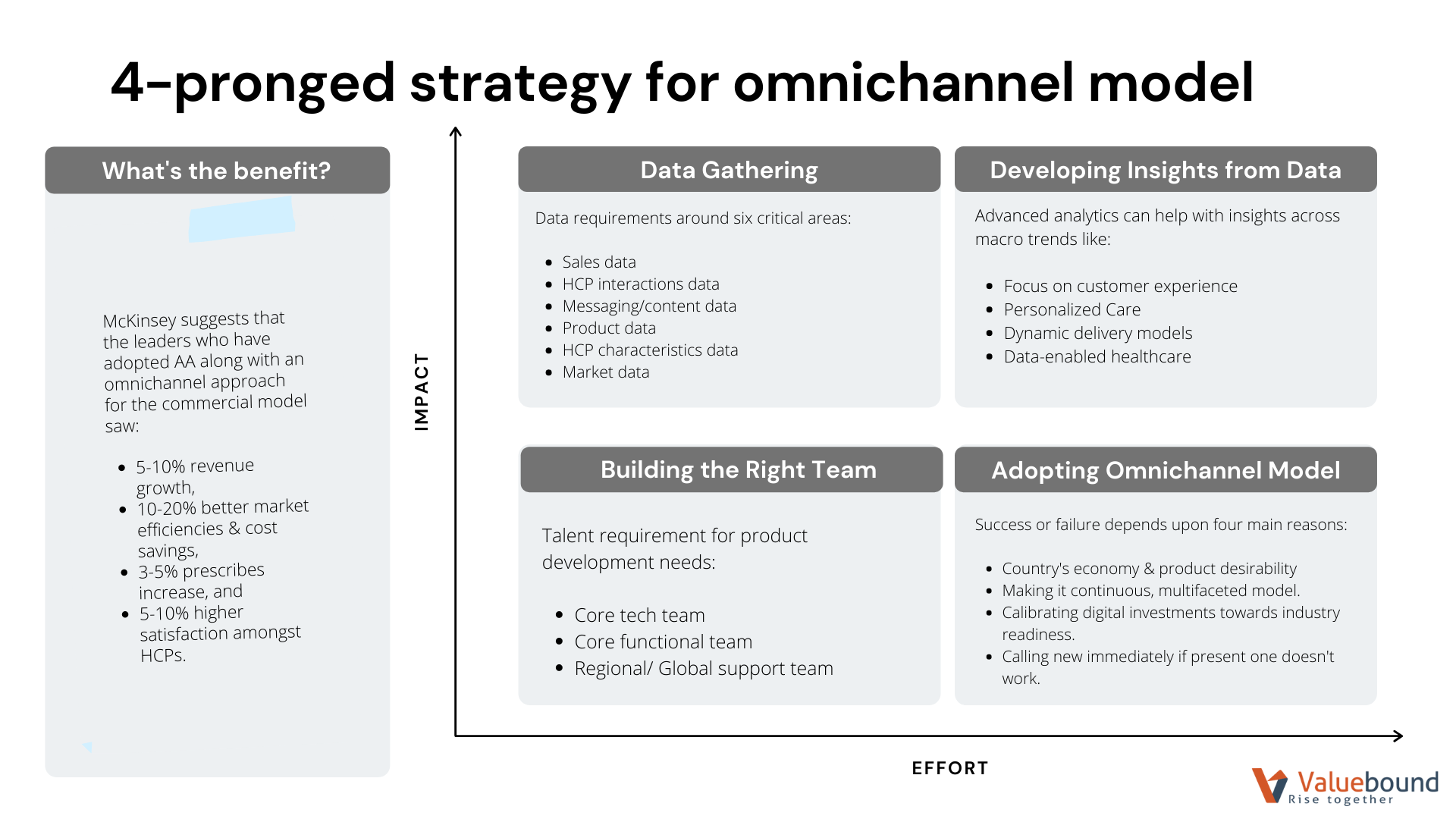

McKinsey suggests that the leaders who have adopted AA along with an omnichannel approach for the commercial model saw 5-10% revenue growth, 10-20% better market efficiencies & cost savings, 3-5% prescribes increase, and 5-10% higher satisfaction amongst HCPs. Such improvements are a result of differentiated insights through AA which can guide commercialization such as, creating channels and personalized messages for each HCP, and allocating resources.

Suggested Strategy for Omnichannel Marketing

The Omnichannel commercial model helps in upgrading the way pharma works, by upskilling for a tech-enabled world, and personalized engagement which creates value. Continuous feedback from the market helps in strengthening optimization power and predictiveness of analytics systems.

We suggest a four pronged strategy involving data gathering, developing analytics models, building the right team, and adopting the same (Fig. 3)

What kind of data needs to get gathered?

Data collection through CRM systems around HCP interaction details, market-specific data like competitive landscape, demographics, sales data, content, and through third-party is already available with the marketers. For developing an omnichannel commercial model for pharma, such datasets can be interconnected to create a holistic view of HCPs and customers. For developing insightful analytics, McKinsey describes six criteria for data requirements:

- Sales data about products for each HCP or certain groups of HCPs. This helps in understanding sales estimation at individual HCP level, thus understanding sales impact through analytics.

- HCP interactions data which is customized at individual level. This helps in channel and frequency recommendations.

- Messaging/content data which is interconnected to interaction data. This helps in content modeling.

- Product data which is mapped across sales and interactions with individual HCPs.

- HCP characteristics data including basic details, demographics, patient estimate at brand level. This helps in sales estimation at individual level, and also enables micro-segmentation.

- Market data like epidemiology, market access, competitive environment, market events, and market access.

Compliance and regulatory requirements must be fulfilled for each country during the data collection process.

What are the analytics insights from data gathered?

Advanced analytics can help pharma companies gain deeper understanding and insights across macro trends, which are:

- Focus on customer experience- At the core of omnichannel approach is customer-centric experience, which must flow across channels in a seamless manner. Mary Alice Dwyer, Chair of Medical Affairs Digital Strategy Council says, “A company must embed digital in its operations and ways of working, rather than bolting it on as a separate project or through a separate team,”

- Personalized Care- Audience segmentation using derived analytics can enable personalized engagement, which is measurable and assists pharma companies in charting the future campaigns with impactful messages, especially before launching a new drug. Patient-focused marketing can boost engagement rate by 20-90% depending upon the segment.

- Dynamic delivery models with Innovative solutions- like AI and AA have the capacity to digitally transform commercial models of pharma companies. Insights through advanced analytics enable strategizing, improving product quality, and ensuring consistency.

- Data-enabled healthcare- Companies that can leverage data have the edge over competitors in terms of contracting analytics, predictive pricing modeling, dynamic forecasting, advanced segmentation, and sales force performance.

What kind of talent requirements do we need?

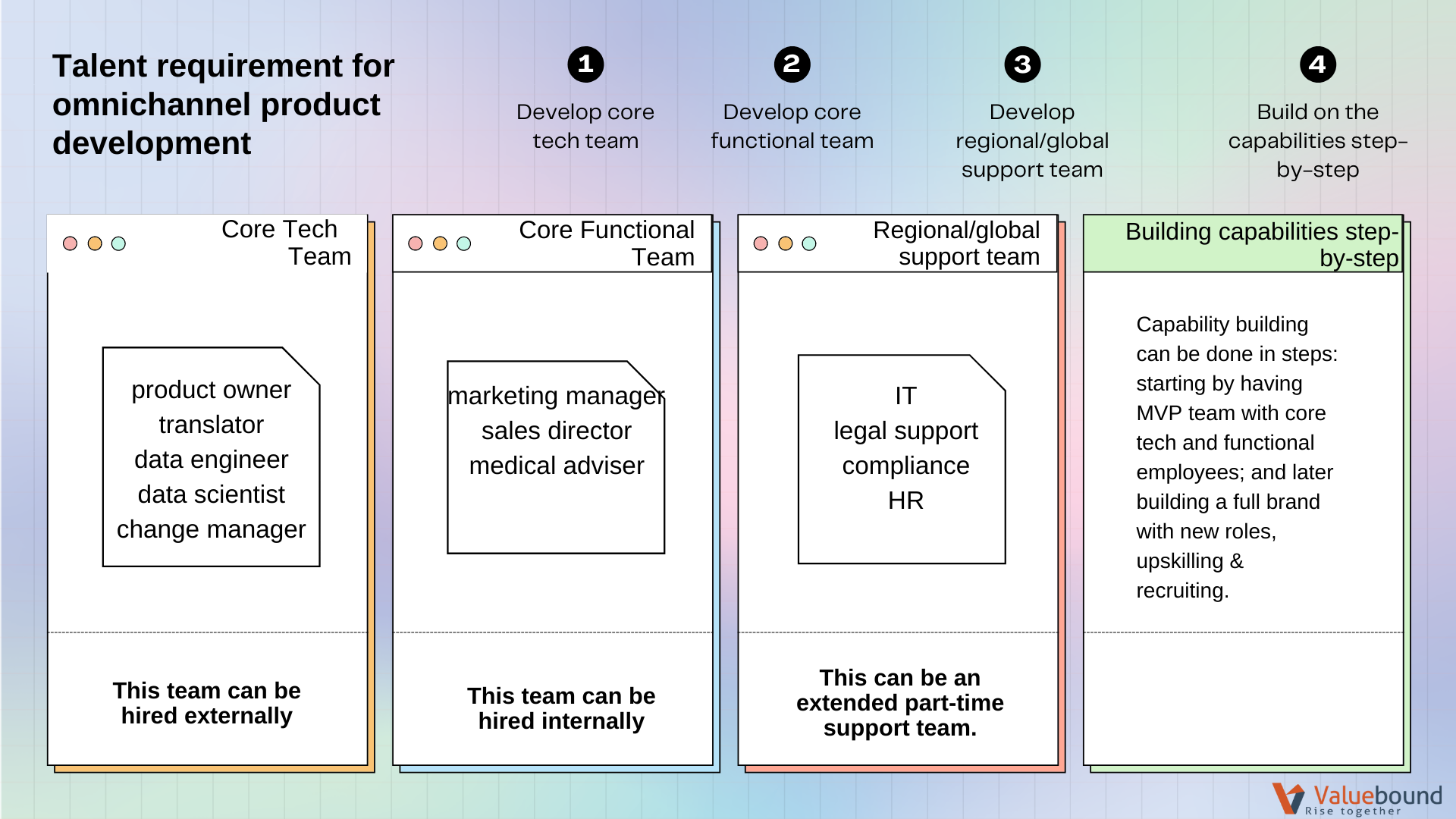

Analytics-driven marketing efforts require pharmaceutical brands to partner with tech companies that are data-driven. Typically, omnichannel commercial model of pharma companies require tech team which includes-

- product owner

- translator

- data engineer

- data scientist

- change manager

On the functional side, the companies would need representatives like marketing manager, sales director and medical adviser. (Fig. 4)

Average penetration of digital talent for Asian countries is double that of the US, suggests APEC Closing the Digital Skills Gap Report, 2020. The pharma companies face the major challenge- job profiles of designer, translator, data engineer, and data scientist in life sciences and healthcare sector. While hiring tech talent for pharma could be challenging, it shouldn’t stop the companies in pursuing holistic omnichannel commercial models. But, the change must begin from the top. Harvard Business Review report notes, ‘It has never been clearer that leadership — both good and bad — cascades down to impact every single aspect of the organization, with as much as 50% of the variability in group or unit performance being attributable to the individual leader.’

How to adopt Omnichannel model pan-organization?

A company’s success or failure for any of its digital capability depends on several factors. Harvard Business Review, in its report ‘Why so many high profile digital transformation fail,’ underscores 4 main reasons:

- Economy of a country or product desirability can affect omnichannel commercial model adoption for pharma companies. That is why, leadership should not see technological innovation or digital marketing solutions as its only salvation.

- Advanced Analytics for an omnichannel commercial model is not a plug-and-play thing, but is a continuous process powered by robust change management within an organization. It requires infrastructure, IT systems, projects, and skills Additionally, it requires ongoing monitoring and introspection.

- Digital investments must be calibrated towards industry readiness focused on both customers, and competitors.

- If the efforts aren’t going well, there must be a call for a new model.

Looking ahead

Pharma marketers may be tempted with the idea of radical technological change in the early phases of the new technology to dominate new markets, rather than learning about the market through valuable insights. Investing ahead of a new technology curve in pharma only makes sense when the marketers are aware about where the curve actually is. The way forward is clear-headed decisions regarding the omnichannel commercial model for pharma companies through advanced analytics. In our next blog, we shall focus more on the “how to” part of solving the omnichannel commercial model for Asia-pacific Pharma companies by discussing a 5-step REACT journey to achieve transformation.